Transparent and accurate financial records instill trust among customers and stakeholders. In ecommerce, where customer trust is paramount, a well-maintained and streamlined bookkeeping system contributes to the credibility of the business. Streamlining bookkeeping tasks involves optimizing and simplifying the various processes related to financial record-keeping, transactions, and reporting.

- Additionally, you should gather all of your receipts, keep them safe, and keep them for at least three years (the IRS’s standard audit period).

- Whether you DIY it or have a bookkeeper maintain your chart of accounts, this is something that you should do monthly – if not weekly.

- There’s the day your product is market-ready, the day you open your online store to the world, and the day you make your first sale—a major step that calls for celebration.

- In ecommerce, where customer trust is paramount, a well-maintained and streamlined bookkeeping system contributes to the credibility of the business.

- Like any business, managing an ecommerce company comes with considerable expenses.

- When you use accounting and bookkeeping together, you can keep track of your financial figures.

But it’s important to reiterate how essential it is for an ecommerce business. Some platforms offering ecommerce services have built-in inventory management tools. However, if you’re selling from multiple places, tracking changes to the inventory becomes difficult. The cash flow statement is probably the most important document for any type of bookkeeping. Rent, inventory, maintenance, income stream, and taxes are all in this statement. For example, if the popularity of a specific item spikes, the cash flow will reflect it.

CPA Automation: 5 Benefits of Automated Accounting For CPA Firms

Bookkeeping can be a lot of work, especially if you’re an already busy small business owner. Procrastinating and failing to document transactions could lead to bookkeeping work piling up and make your records very difficult to manage. If you find yourself falling behind or feeling overwhelmed by bookkeeping, ecommerce bookkeeping it’s a good idea to hire a professional bookkeeper who can put in the hours needed to keep your books up to date. The margin between your cost of goods sold and net profit should be stable as well as predictable. And always remember to record your cost of goods sold when you sell each piece of inventory.

Digital bookkeeping provides quicker access to transactions including financial information like balance sheets, or profit and loss/cash flow statements. The relevant sales tax will be computed and collected from your clients via a number of e-commerce platforms. Tax money is a liability that you owe the government; it is not the same as revenue. The difference between revenue, sales tax, fees, and the last cash deposit into your bank account must be documented in your books. Create financial reports (income statement, balance sheet, and cash flow statement) every month and every three months to track the development and trends of your company.

Bookkeeping Best Practices: 7 Steps To Conquer Your Books

You can choose from various e-commerce platforms to find the right one for your business needs. Without a balanced AR and AP, you could be overspending or not receiving the appropriate payments. Generally Accepted Accounting Principles (GAAP) recommend keeping your personal and business finances separate. Bookkeeping encompasses the basics of tracking expenses, invoices, and payroll.

- Without adequate records, suppliers might tamper with them or workers might abuse company credit cards without your knowledge.

- Regularly analyzing these reports provides insights into your revenue, expenses, and overall profitability.

- Due to regular changes and updates that tax authorities introduce, it remains one of the most complicated taxes that ecommerce businesses are liable to.

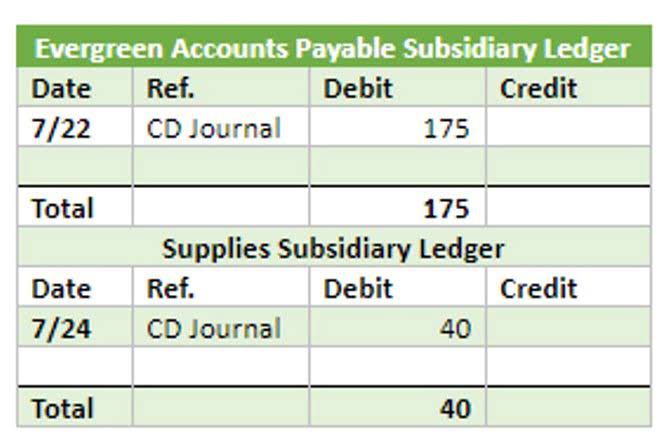

- The bookkeeper should record all unpaid invoices in the accounts receivable while all unpaid bills should be recorded in accounts payable.

- And, since having a good amount of choices is ideal, be sure to check out Webgility software accounting services, too.

With robust accounting processes, however, you can maintain an organized set of books and accurately track data for future decision-making. Monitoring your accounts payable (AP) and accounts receivable (AR) are integral to keeping your books healthy. AP records all the company’s payments to debts and loans, while AR records payments customers owe the company from sales.

The Savvy Bookkeeping Blog

In case you need a hand, we’ve got short videos and step-by-step instructions to help you learn how to use QuickBooks. Maintaining an organized, cost-effective inventory is perhaps the most important aspect of any retail e-commerce business model. Maintaining inventory is more than just stockpiling items you intend to sell; it also means keeping track of your inventory cash flow.